As a business owner, you want a low interest rate business loan without few hassles. Obtaining a loan interest rate can be time consuming if you are not ready. In brief, there is a cost associated with obtaining a low interest rate on your business loan. In short, the cost is either time or money. In this article you will not that if you don’t have all the required documentation, this will cost you time. Moreover, you will not that if you don’t have all your paperwork ready you may need to hire experts. Otherwise, you paid the price already to have everything in place to obtain a great business loan.

This isn’t an easy task to achieve. Obtaining a low rate requires a lot of time, effort and hard work, and many business owners get discouraged. Other business owners don’t end up taking a loan, because they cannot obtain a low rate. Lastly, the rewards are well worth the obstacles you’ll face to obtain a low interest rate.

As you can see, there is a lot to consider before you obtain your business loan. Let’s examine a step-by-step overview of what you need to do to obtain a low interest rate.

9 Requirements to obtain a low cost business loan

In this article…

1. Obtain business loan requirements

2. Obtain a copy of your credit report

3. Evaluate your credit report

4. Review your business bank statements

5. Review your financial statements

6. Prepare your corporate tax returns

7. Make any financial changes

8. Apply for your business loan

9. Obtain a low interest rate

1. Obtain business loan

requirements

Before you apply for your business loan, you need to become familiar with the requirements. The lowest interest rates for business loans are business lines of credit, bank loans and SBA loans. You need to know the credit score requirements. Your credit score alone, will not do the trick. You may have a 700-credit score, but you only have one credit card. This may not be enough credit to obtain a low interest rate on your business loan. Banks and lenders want to see that you have enough credit cards, auto loans, personal loans and other loans that are active. They want to know that you can manage credit.

Cash flow requirements

Do you know the cash flow requirements? Banks and lenders will analyze on how you manage cash flow. With this in mind, lenders will review your gross earnings, net earnings and bank statements. Without a doubt, if you have too many overdrafts, non-sufficient fund activity and other adverse activity on your bank statements you will probably not obtain a rate. Find out if they need financial statements and what calculations they use to make a credit decision. Once you know the requirements, you can determine what you need to work on.

2. Obtain a copy of your credit report

The next step is to obtain a copy of your credit report. There are many online portals you can use to obtain your credit report online. Make sure you obtain a tri-merge credit report. A tri-merge credit report means that you obtain a report from all three credit bureaus; Equifax, Experian, and Transunion. Some creditors report only to one agency, while other report to all three agencies. The cost to obtain a credit report, may range from $10 to $30 dollars. It’s well worth the investment, if you want to obtain a low rate.

Access to free credit report monitoring.

3. Evaluate your credit report

In the first place, you need to evaluate your credit report. Bankers, small business financial specialist, credit specialist and attorneys know how to read credit reports. First, examine your scores. Second, examine your balance to limit ratios. This is the amount that you currently owe versus the limit on credit cards. For instance, if you have a limit of $1,000 and you $900, this is not good. Make sure that you owe about fifty percent of the limit amounts on credit cards. Before you apply for a business loan, make sure to reduce balances. Third examine the amount of trade lines you have.

Trade lines are important

Trade lines means, the amount of loans and credit you have open. To illustrate, if you have a student loan, three credit cards, and car loan, you have five trade lines. What if you have one trade line only? One trade line will not be enough to obtain a low interest rate. In this situation, you may need to obtain new credit before you apply for business funding.

In this case, this now becomes a process because you need to demonstrate credit history on each trade line you establish. Just because you took out three credit cards in the last 30 days, will not demonstrate to a lender that you can manage credit properly. Clearly, banks and lenders want to see at least five open trade lines under management. Apart from this, they want you to demonstrate that have managed credit for the last two to four years.

The credit myth

Most business owners think that just because they have a 700-credit score, that this will be enough to meet lending guidelines. That is a myth. Think of your credit like a money management fund. Would you invest money to a money manager that has only managed one account? Or, would you invest money with a money manager that has managed over 500 accounts? Business lenders feel the same way about you.

When you manage 10 credit cards, 1 business loan, 2 auto loans, 1 mortgage and 1 student loan you demonstrate to lenders credit management. Managing credit includes paying on time, conscious about balances and other management strategies.

Check for errors

Also, you want to see any erroneous reporting. Sometimes, consumers are a victim of fraud. There may be wrong information reporting on your credit report to include:

1. Old accounts

2. Charge offs

Maybe, ten years ago you forgot about a medical account or student credit card which you forgot to pay.

In view of this, you want to take care of all of this before you apply. What if you don’t have your credit report impeccable? Than, you will need to work on it.

Monitor you credit

To improve your credit you can utilize a monitoring system online. Today, there are online solutions that can monitor your credit month to month. Straightaway, they will give you recommendations online on how to improve your credit history and credit score. Enroll in a credit monitoring service. Credit cards issuers usually offer credit reporting services. This may take one to twelve months to see some serious changes in your credit report. Keep in mind your credit report will not change by itself, you need to work on it. Credit monitoring systems will give you tips and what you should do.

In addition, there are credit simulators. A simulator will indicate to you what your credit score could be if you took specific actions. The credit monitoring systems will not work alone. You will need to do some of the work in order to increase your credit score.

Try out free credit monitoring

4. Review your business bank statements

It’s time to go online or go to the bank. You can obtain your business bank statements online. Most major banks have great online portals, where you can download your bank statements PDF. If you don’t like the internet, walk into your bank and request them. You want to obtain at least the last twelve months of bank statements. Once you obtain them, you need to review them. You can use excel and input the following information for each month. Opening balance, deposits, and close out balances. This is the first financial information you need to review on your business bank statements. Negative close out balances at the end of the month may prevent you from obtaining a low rate.

What is a debt service coverage ratio?

Are you familiar with the debt service coverage ratio? This is formula that banks, and lenders use to determine if you can pay a monthly payment on a business loan. Google; debt service coverage ratio and it will provide you the formula. A rule of thumb is that your monthly close out balances should be double the amount of the monthly principal and interest payment on the business loan you want.

For example: a monthly business loan payment with $2,000 per month, may require for your close out balance to be about $4,000 per month. This means that every single month for the last 12 months, your close out balance should be $4,000. This reveals that you have sufficient capital at the end of the month to cover the loan payment.

Your average daily balance

Next, you want to review your daily average. Most business bank statements report an average daily balance. When you have more than three negative average daily balances, you will need to make some major cash flow management adjustments. A negative average daily balance, means that you spend more than what comes in on daily basis. By and large, this demonstrates to business lenders poor cash flow management.

Last, review all derogatory charges. Business lenders don’t like businesses that have overdraft fees, unpaid check fees, bounced checks and other financial transactions of that nature. With all due respect if this is your situation, you will need to be more careful in how you manage cash flow.

5. Review your financial statements

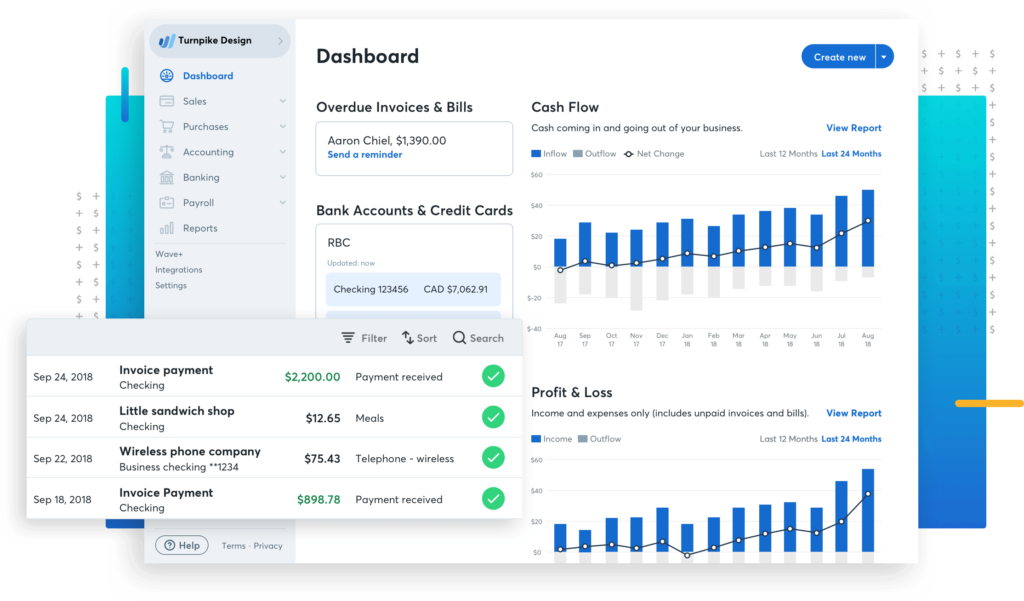

Hopefully, you have a month to month profit loss statement and a balance sheet. Most small businesses don’t have month to month financial statements. You can fix this fast. You can use an online cloud base accounting system that integrates data from your business bank account. Since you have not done this for the last 12 or 24 months, you may need to upload previous bank statements. Once you do this, you will need to categorize every item and create financial statements. This can consume a lot of your time from running your day to day operation. At this instant you have to decide. Will you perform this yourself or will you hire someone?

Do you have profit to loss statements ready?

Having your financial statements ready, place you ahead of the process. Just make sure that the information matches your bank statements. Any information that does not match, may cause your loan request to be denied. Business lenders match profit to loss statements to bank statements and check for any inconsistencies. Lenders want to give loans, but credit review teams assess risk and look for inaccurate information. An underwriters objective is to protect its investors.

You may need to make a small investment

Also, check your balance sheets to make sure everything makes sense. Not having your financial statements ready may cost you from $1,000 to $5,000 dollars. Depending on the size of your business. You must do a cost benefit analysis. Is it worth the time and cost to obtain a low interest on your business loan, or not? Investing $5,000 to save $10,000 of interest, may be worth it. Besides, your accountant will be happy.

Try out today “CLOUD BASED BOOKKEEPING”

Starter loans as a stepping stone

Today, there are alternative financing solutions at a higher cost. Paying a higher interest rate on an alternative business loan that does not require all of this, may be worth it because it will serve as a stepping stone. There are alternative business lenders, who will not require financial statements. Financial statements are very important to any business, because they allow you to measure income and expenses. More important, it measures profitability.

6. Prepare your corporate tax returns

To obtain a low interest rate on your business loan, you need to have at least two to three years of corporate tax returns prepared. Business lenders prefer gains as oppose to losses on those tax returns. There is a huge financial trade off. If you have a gain, you will end up paying taxes to the internal revenue service. This is the cost you must pay to obtain a low interest rate on your business loan.

Reporting a loss may have alleviated you from paying high taxes to the internal revenue service. However, you will not get a low rate. You need to outweigh this cost. You can’t get away with murder. This means, you cannot obtain a low interest rate and not pay taxes to the internal revenue service.

Are you reporting everything to the IRS?

Most businesses that obtain a business loan, show a gain and pay taxes to the IRS. Is the cost worth it? Only you can answer that.

You may need to wait

Some business owners will need to wait until they show steady revenues or increasing revenues on those corporate tax returns. Does the information reporting on your corporate tax returns, match your bank statements, and your financial statements? In essence, your accountant can be a great asset in this phase of the process.

Don’t worry if you don’t have all of this. There are alternative means of obtaining financing for your business that will not evaluate all this data. Altogether, this is what you will need to obtain a low interest rate on your business loan.

Editor’s Note: Looking for information on business loans? Fill in the questionnaire, and you will be contacted by lenders ready to discuss your loan needs.

7. Make any financial changes

Making financial changes does not mean alternating documentation. You can adjust a corporate tax return, but you will need to file an adjustment. Consider this, you cannot go back to any given month on a bank statement and make changes. Your financial statements can be adjusted to reflect only accurate information. Without a doubt, there are limitations on the changes you can make on financial activity that occurred in the past.

What happens when you are not ready?

Sooner or later, you will need financial statements. To that end, you may need to hire a bookkeeper, reduce expenses, report profits, and make your business profitable. Each business is different and only you can determine what changes need to be made.

Well worth the cost

While this may require time, effort and money it is well worth the cost. In the end, not only will you obtain a lower interest rate, but you will manage cash flow much better for your business. By managing cash flow better, you will make your business more profitable. For this reason, determine what changes you need to make before you apply for a business loan with a low rate.

To clarify your fears, this does not mean that you can obtain a business loan. Of course, there are other business loans in the market that may not require all of this but the interest rates are higher. In fact, this is the cost you pay, for not doing things properly in the past. There is a price you must pay in the front end or the back end.

Take the steps necessary

In any event you must take action. To emphasize, it’s called “good cash flow management administration.” Therefore, you need to set out a plan that measures every financial aspect of your organization.

In truth, you will need to conduct these check points, on a regular basis to avoid any negative financial activity. Important to realize, there is a trade off to everything in life. Surprisingly, the trade off you are seeking is paying a low rate versus measuring finances.

8. Apply for your business loan

Do you have everything ready? Contact your business lender or bank and apply. Soon, you will be enjoying a low cost rate.

Undeniably, some of you may not be ready. Seeking alternative funding channels will be your only temporary solution. Some business loans only require the last four months of bank statements and loan application. Other business loans require only one year of financial statements and bank returns. Invoice financing may only require your invoices and your accounts receivable ledgers. In other words, become familiar with other alternatives. Hopefully you have all documents ready to obtain a low interest rate loan.

9. Obtain a low interest rate

Unquestionably, if you meet all the requirements you will obtain a low interest rate . Obviously, if you don’t all of these items than you may pay a higher cost. Now, you know what you must do to obtain a low-cost loan.

Congratulations; you are ready !!!

In summary, this requires a lot of work if you have not already taken these steps. Congratulations, if you have everything ready and you can meet the loan requirements. Mistakes are going to happen, and how you deal with them and learn from them is really one of the major keys to obtain a low interest rate. Above all, balance limiting your mistakes, learning from them and correcting them as soon as possible. As has been noted, you will be closer to paying less money in interest costs. Running a business is not easy. Don’t feel bad, if you don’t meet stringent requirements. To demonstrate, eight out of ten businesses do not meet all the requirements to obtain a low interest rate.

Don’t give up. Just because you don’t obtain a low interest rate on your loan, does not mean that you can’t in the future. In fact, taking alternative business loans with other lenders will help you build business credit. In short, everything that you do will help you to obtain a low interest rate business loan.